Over the years, Banking services corporations have started to expand their business activities at an extensive rate. This transformation has started to occur due to the growing expectations of the stakeholders who want continuous improvements in delivery standards and quality of services.

Thus, it becomes necessary to consider the QA (Quality Assurance) process for financial services as it can help these banking corporations to cope up with the changing scenarios of the banking sector. The management of banking services corporations has committed to improving service quality with software testing services and is striving to make any efforts that could transform the banks into new and competitive organizations.

Since Quality assurance is a new buzz in the banking industry, it will now be responsible for the system evaluation and suggesting quality assurance standards with the best business practices. The banking sector has therefore developed the need to devise a few methodologies to augment its business operations effectively.

Clearly define goals with a matrix of service delivery performance criteria.

Establishing a benchmark of quality levels.

Strengthening of standards and procedures at the corporate level.

Evaluating performance of banking domains and fix its glitches from the best software testing companies.

Efficient use of available resources with appropriate delegation of powers among various hierarchy levels to complete the tasks quickly and cost-effectively.

Performance evaluation of different services and delivery standards & making recommendations is ideal for enhancing customers' satisfaction.

Analysis of surveys/studies to ensure the correct implementation of quality assurance services or deliveries.

Elimination of redundant internal procedures/ procedures and over-lapping/duplication.

Creating Standard Operating Procedures (SOPs) in accordance with globally recognized best practices.

To achieve more digitization, it is necessary that banking institutes should adapt to advanced technologies like Artificial Intelligence, Cloud Services, Machine Learning, and Blockchain in banking systems. In addition, Customer Data Security and Customer Experience should be the primary focus for financial sectors as implementing the aforementioned practices could help customers get an excellent application experience while using any banking system.

Today's customers are looking for digital-based banking applications that are easy to load, operate and provide a smooth transaction processing experience. Moreover, customers also want to get a secure and reliable option while connecting the banking application with various mobile devices.

The spread of COVID-19 has made banking professionals introduce their customers to mobile banking apps for day-to-day tasks such as creating an FD (Fixed Deposits) and Recurring Deposits. Apart from that, users are also prioritizing to get access to online banking and need an interface that is safe to operate for multiple transactions' features. Thus, it is crucial that customers could experience ease right from the loading of the apps within few seconds to any operations that need quality with performance.

Besides, there are various challenges associated with the banking industry that needs to be considered and worked on at the earliest. These include increasing competition, a cultural shift, rising expectations, regulatory compliance, changing business models, customer retention, outdated mobile experiences, and security breaches.

Though these challenges are easy to overcome, these need banking firms to lend a helping hand to the Best Software Testing Company for their expertise of software testing service that could help in assuring the quality of core banking solutions.

In case you are still not convinced of the benefits quality software testing could offer to your banking business, we have got the statistics to justify the performance improvements. When testing the performance of a banking application using JMeter, our clients have achieved the following benefits:

Reduce risk and overall time for the testing life cycle.

Improve response time by 70%.

Fulfill production server requirements based on performance data.

Help in cost and time saving by performing the test under tight deadlines.

Represent the response time, throughput, possible error percentage, and utilize server resources' current infrastructure.

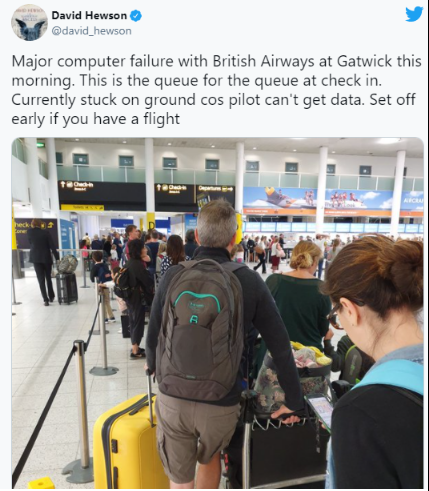

Millions of banking customers were unable to access online accounts. It takes about two days to fix the internal technical issues of the HSBC system that offers online banking services. In August 2019, British Airways experienced an IT glitch, but its customers faced nearly 200 flight cancellations and flight delay issues.

Resisting Quality Assurance could bring similar glitches to your business and may even turn catastrophic. Find your way to highest quality and lowest risk with Bugraptors.

If you avoid QA testing and software testing in banking domain, you are likely to face severe performance issues at any point in time. In other words, serving the best to your customers’ needs you to be a high-performing financial institution that understands the importance of QA testing and software testing services, as it is the only way to prevent losing your potential customers.

Lack of Readiness: This peril assumes organizations don't bring QA on board early in an initiative, or they make delays while adding QA resources. Planning is a must for contractual agreements, and one should consider the third-party vendor on time to avoid quality assurance issues in the banking domain.

Underestimating the effort: A major effort should be made for all QA management activities that involve Test Planning and Approvals, Test Case Writing, Test Implementation, and Defect Remediation.

Lack of Skilled QA Resources: When choosing unprofessional software testing companies, QA testing goes in the wrong direction. One should always choose the best software testing company, especially the skillful team of testers, as they know how to use business resources effectively. They can help you get excellent outcomes after performing QA testing on your banking system. QA companies should not introduce modern testing technologies without rigorously evaluating them. They should provide the quality according to the customer's testing requirements.

Over-testing: Testing should be provided according to the need for financial services since over-testing can consume more time and ensures high costs.

Lack of Subject-matter Expertise: Subject-matter expertise is needed for a Core Banking System because it is a centralized digital system used by banks and their branches for real-time transactions and services. Ensuring the quality of core banking systems is requisite for the survival and reputation of banks. The software testing company should perform thorough-based continuous testing for all core banking services to make sure these services will offer high-quality performance to users.

Before choosing software testing services or taking QA testing for your banking systems, you need to hire a trusted team of software testing companies. This will help you reach experts that have appropriate resources such as project management, technical leads, business analysts, quality assurance testers, and many more. All in all, with QA-trained resources, you can easily improve the quality of banking applications.

Always consider those software testing companies who have immense QA management expertise in both process and testing and know-how to satisfy the QA needs of any banking system. You need to check the background of the QA team, such as:

Technology expertise.

Automation experience.

Functional experience.

Performance/system testing knowledge.

Good communication skills.

Are you curious to find out how QA helps banking sectors in their digital transformation? So, the answer is a Model-Based Testing Approach that is used by software testing companies with IT toolsets to speed up the creation of test scripts.

Companies can use model-based testing tools for capital market firms because these tools allow generating test cases automatically. Whether it is the matter of models, describing the application, or creating test cases for systems under test, this method is suitable for the reusability and testing of various applications with similar functionality.

BugRaptors has Model-Based Testing solutions for commercial applications, including SEPA Direct Debits and Credit Transfer and Global PAYplus for payments, VisionPLUS, TSYS for cards, SAP Core Banking, Temenos T24, and several best test practices for all banking departments, card issuers, card acquirers, and other financial organizations.

We use pre-built models to kickstart your testing efforts for banking applications. Moreover, BugRaptors can help you reduce post-production defects by 30% or more and test execution time by 15% while ensuring a 0% defect leakage guarantee for production.

Are you looking for experts to grab the cost-effective QA Testing Services for your finance or banking firm? Find the right assistance with Bugraptors. Contact us today.

Interested to share your

Read More

BugRaptors is one of the best software testing companies headquartered in India and the US, which is committed to catering to the diverse QA needs of any business. We are one of the fastest-growing QA companies; striving to deliver technology-oriented QA services, worldwide. BugRaptors is a team of 200+ ISTQB-certified testers, along with ISO 9001:2018 and ISO 27001 certifications.

Corporate Office - USA

5858 Horton Street, Suite 101, Emeryville, CA 94608, United States

Test Labs - India

2nd Floor, C-136, Industrial Area, Phase - 8, Mohali -160071, Punjab, India

Corporate Office - India

52, First Floor, Sec-71, Mohali, PB 160071,India

United Kingdom

97 Hackney Rd London E2 8ET

Australia

Suite 4004, 11 Hassal St Parramatta NSW 2150

UAE

Meydan Grandstand, 6th floor, Meydan Road, Nad Al Sheba, Dubai, U.A.E